Art Salmi: Discovering Creative Insights

Explore the world of art and creativity with insightful articles and inspiration.

Insurance Discounts: The Hidden Treasure Every Driver Needs

Unlock the secret to saving big on car insurance! Discover amazing discounts every driver should know about today.

Unlocking Insurance Savings: A Guide to Discounts Every Driver Should Know

Insurance savings can be just a click away if you know where to look. Every driver should take advantage of the various discounts offered by insurance companies to lower their premiums. Some common discounts include multi-policy discounts, which offer savings when you bundle auto insurance with other types like home or renters insurance. Additionally, being a responsible driver can lead to safe driver discounts, rewarding those who maintain a clean driving record. For a detailed list of discounts, check out this resource.

Another way to unlock insurance savings is by taking advantage of educational programs. Many insurers provide discounts for drivers who complete defensive driving courses or other educational programs designed to improve driving skills. Furthermore, don't forget to explore affinity group discounts. These discounts are often available to members of certain organizations or alumni groups. If you're curious about how these discounts can impact your rates, consider reading more at Insurance Quotes for insights.

Are You Missing Out? Commonly Overlooked Discounts for Auto Insurance

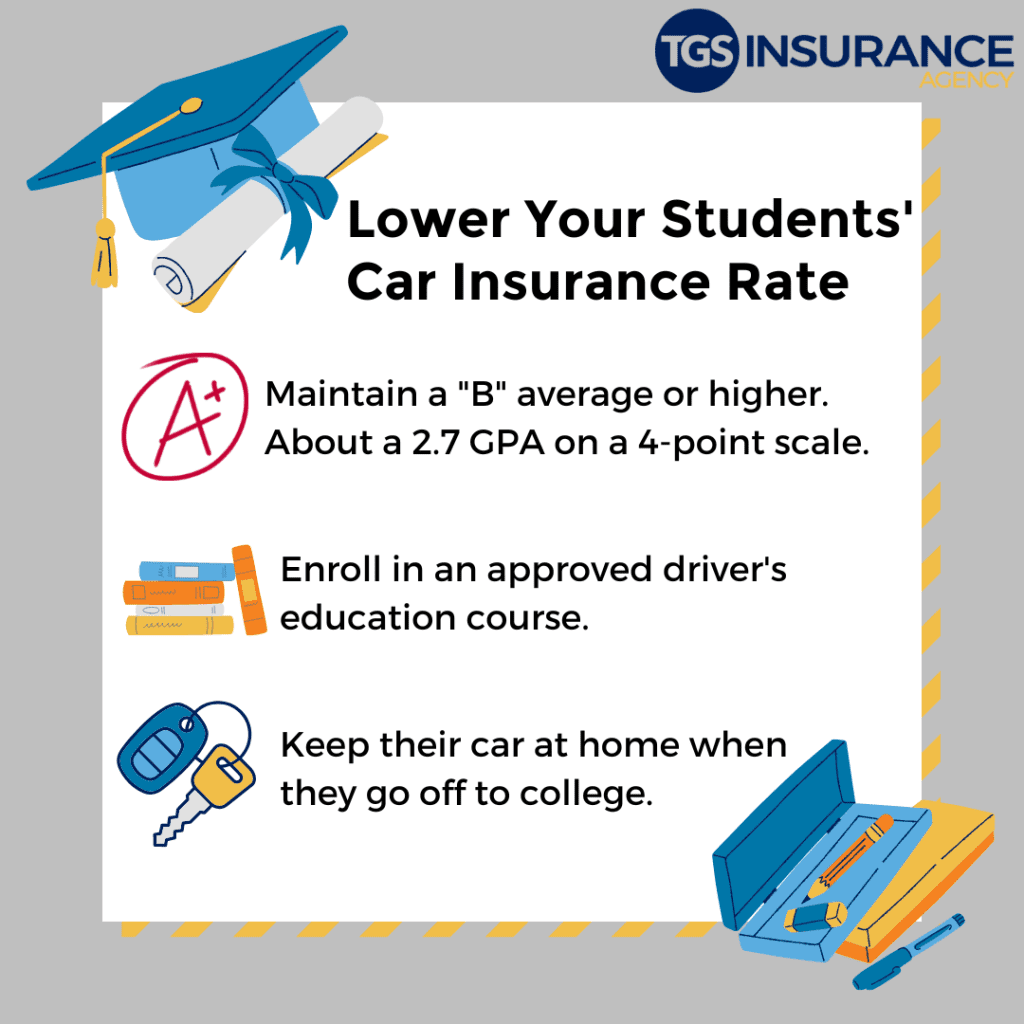

When it comes to auto insurance, many drivers are unaware of the numerous discounts that could significantly lower their premiums. One commonly overlooked source of savings is the multi-policy discount, which rewards customers who bundle their auto insurance with other policies, such as homeowners or renters insurance. Additionally, factors like safe driving records and completion of defensive driving courses can lead to significant reductions. Many providers offer discounts for students who maintain a good GPA or for members of specific organizations, making it vital to ask your insurance agent about all possible options.

Another frequently missed discount is the low mileage discount, designed for individuals who drive less than the average annual mileage. Additionally, consider inquiring about any loyalty programs if you’ve been with the same insurer for several years. Some companies also offer advantages for using certain payment methods or for setting up automatic payments. As auto insurance rates continue to rise, it’s essential to ensure you’re not missing out on the savings you deserve. By actively exploring these commonly overlooked discounts, you can make informed decisions to keep your insurance costs down.

How to Maximize Your Insurance Discounts: Tips for Every Driver

Maximizing your insurance discounts is essential for saving money and ensuring you get the best coverage possible. Start by shopping around and comparing quotes from various insurers. Websites like ValuePenguin can help you analyze rates from different companies. Additionally, many insurers offer discounts for good driving records, so maintaining a clean driving history can significantly lower your premiums. Bundling your insurance policies, such as combining home and auto insurance, can also lead to considerable savings, so be sure to ask your provider about these options.

Another effective strategy is to take advantage of driver education courses. Many insurance companies provide discounts for completing recognized defensive driving courses. These courses not only improve your driving skills but also may qualify you for significant discounts. Furthermore, consider reviewing your coverage regularly. As your car depreciates, you may not need as much coverage as before, leading to potential savings on your premiums. For more detailed information on finding the best discounts for your situation, check out Insurance.com.