Art Salmi: Discovering Creative Insights

Explore the world of art and creativity with insightful articles and inspiration.

Renters Insurance: Because Your Stuff Deserves Better Than a Prayer

Protect your belongings with renters insurance—because your stuff deserves more than just hope! Discover why coverage is a must.

Understanding Renters Insurance: What It Covers and Why You Need It

Renters insurance is a type of insurance designed specifically for tenants, offering financial protection for personal belongings in the event of unforeseen circumstances such as theft, fire, or water damage. Typically, this insurance covers personal property up to a specified limit, as well as liability coverage in case someone is injured while at your rented residence. Most policies also include additional living expenses (ALE) in scenarios where you cannot live in your unit due to covered damages, ensuring that you have support during challenging times.

Understanding the ins and outs of renters insurance is crucial for anyone leasing a property, not just for safeguarding personal items but also for peace of mind. Without it, you could be responsible for replacing your belongings out of pocket, which can be financially devastating. As you consider your options, it's crucial to compare different policies to find the best fit for your needs. Resources like Nolo can provide valuable insights into the importance of renters insurance and how it can protect you and your assets.

Top 5 Myths About Renters Insurance Debunked

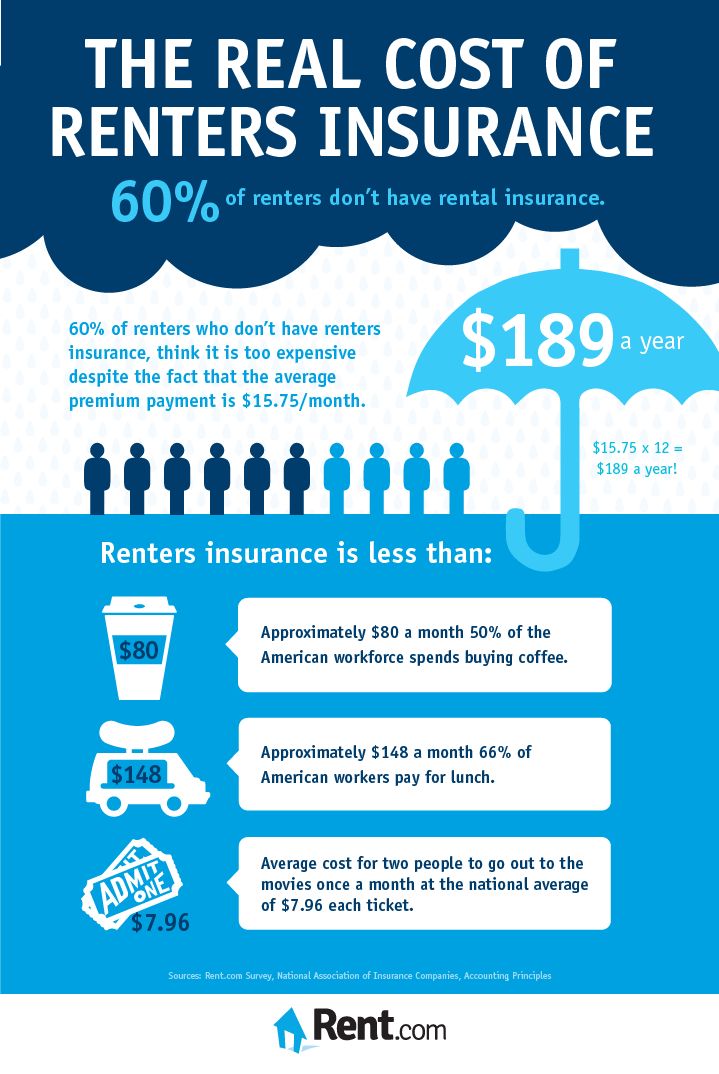

Many people hold misconceptions about renters insurance, leading them to either forgo it or choose inadequate coverage. One prevalent myth is that renters insurance is only necessary for valuable items. In reality, this type of insurance covers not just personal belongings, but also liability protection and additional living expenses in case of unforeseen events. According to the National Association of Insurance Commissioners, renters insurance is essential for anyone who rents, no matter how much their belongings are worth.

Another common myth is that renters insurance is too expensive. In fact, the average cost of renters insurance is surprisingly affordable, often priced at just a few dollars per month. This low cost provides substantial peace of mind, covering everything from theft to natural disasters. It's important to compare different policies to find one that suits your needs without breaking the bank.

How to Choose the Right Renters Insurance Policy for Your Needs

Choosing the right renters insurance policy is crucial for protecting your belongings and providing peace of mind. Start by assessing your needs: consider the value of your personal items, including electronics, furniture, and clothing. It's also essential to evaluate the risks specific to your area, such as natural disasters or high crime rates. You can use Nolo's guide to help you estimate the coverage you require based on your inventory and location.

Once you have a clear understanding of your needs, compare different renters insurance policies from various providers. Look for factors such as coverage limits, deductibles, and additional benefits like liability coverage or temporary housing assistance. A useful resource is ValuePenguin, which offers a comprehensive breakdown of policy options. Additionally, read customer reviews to gauge the insurer's reputation and claims efficiency. By taking these steps, you can confidently select a policy that aligns with your lifestyle and financial situation.