Art Salmi: Discovering Creative Insights

Explore the world of art and creativity with insightful articles and inspiration.

MFI: My Friend Investment or Missing Funds Indicator?

Uncover the truth behind MFI: Is it your key financial ally or a warning sign? Dive in to discover the secrets of your investments!

Understanding MFI: My Friend Investment for Better Financial Decisions

Understanding MFI, or My Friend Investment, is crucial for individuals looking to improve their financial decision-making capabilities. MFI emphasizes the importance of building a supportive network for financial growth. This concept encourages individuals to seek out friends or peers who are knowledgeable about investment opportunities and financial management. By collaborating with these individuals, you can enhance your understanding of the market, gain unique insights, and make informed choices that align with your financial goals.

One of the primary advantages of MFI is the sharing of experiences and strategies that can lead to better financial decisions. Engaging in open discussions about personal finance can illuminate various investment avenues, from stocks and real estate to savings plans and retirement funds. When you leverage the knowledge of your friends, you can discover new techniques for budgeting and investing that you might not have considered otherwise. So, as you embark on your financial journey, remember to utilize MFI principles to foster collaboration and learn from those around you.

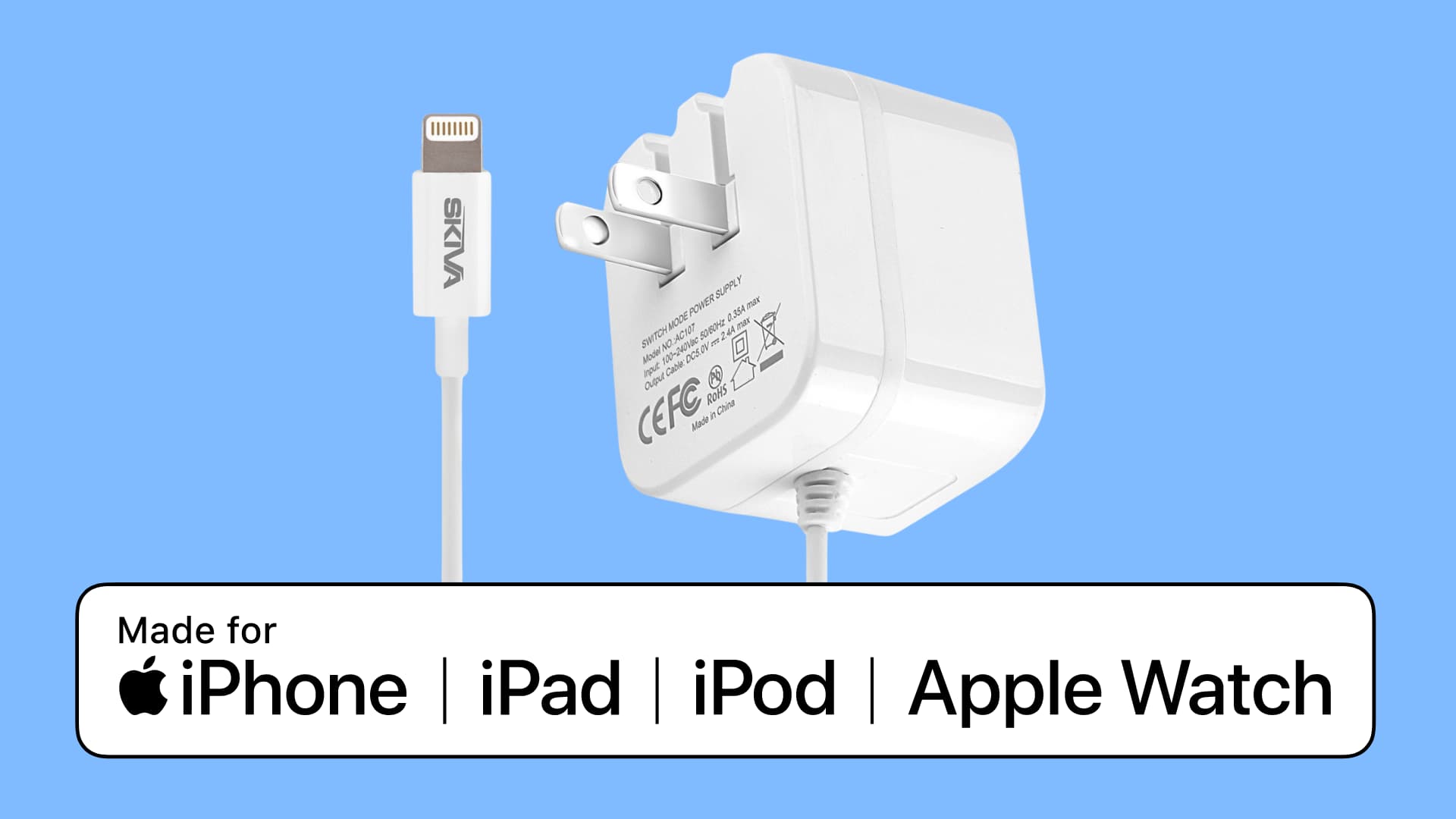

Counter-Strike is a popular tactical first-person shooter game that has garnered a massive following since its initial release in 1999. Players assume the roles of either terrorists or counter-terrorists, engaging in various missions that often involve bomb defusal or hostage rescue. For players who rely on their devices for gaming, it's essential to have reliable accessories, such as the Top 10 iphone charging cables, to ensure uninterrupted gameplay. The game's strategic depth and competitive nature have led to a thriving esports scene, captivating players around the globe.

MFI Explained: How Missing Funds Indicator Can Affect Your Investments

The Missing Funds Indicator (MFI) is an essential aspect to consider when managing your investments. Essentially, MFI serves as a signal indicating that certain funds are unaccounted for in your investment portfolio. This can happen due to various factors, such as administrative errors, discrepancies in fund transfers, or even market volatility. By understanding how MFI works, investors can better assess their financial health and avoid unnecessary risks. For instance, if an investment account shows a significant MFI, it may prompt a thorough review of your financial statements and transactions to ensure that all funds are correctly allocated and available.

Moreover, the impact of a Missing Funds Indicator on your investment strategy cannot be overstated. High MFI levels might lead to potential liquidity issues, where investors are unable to access their cash when needed. This situation can hinder decision-making during critical market opportunities, where timely investments or rebalancing might be required. To mitigate the risks associated with MFI, it is vital for investors to conduct regular audits of their investment accounts and maintain clear communication with their financial institutions. By staying vigilant, investors can safeguard their assets and enhance their investment outcomes.

What is MFI and How Can It Enhance Your Financial Strategy?

MFI, or Money Flow Index, is a technical indicator used to measure the buying and selling pressure of an asset over a specified period. By analyzing price changes and volume data, it provides traders and investors with insights into potential price reversals. Essentially, it helps to determine whether an asset is overbought or oversold, making it a valuable tool for refining your financial strategy. A higher MFI indicates overbought conditions, while a lower MFI signals oversold conditions, allowing you to make more informed investment decisions.

Incorporating MFI into your financial strategy can enhance your overall investment approach. Here are some key benefits: 1. Enhanced Timing: MFI can help you pinpoint entry and exit points more precisely. 2. Confirmation Tool: Use it alongside other indicators to confirm trends. 3. Risk Management: Identify potential reversals to mitigate losses. By integrating MFI with your existing toolkit, you can develop a more robust strategy that allows for better predictions and improved financial outcomes.