Art Salmi: Discovering Creative Insights

Explore the world of art and creativity with insightful articles and inspiration.

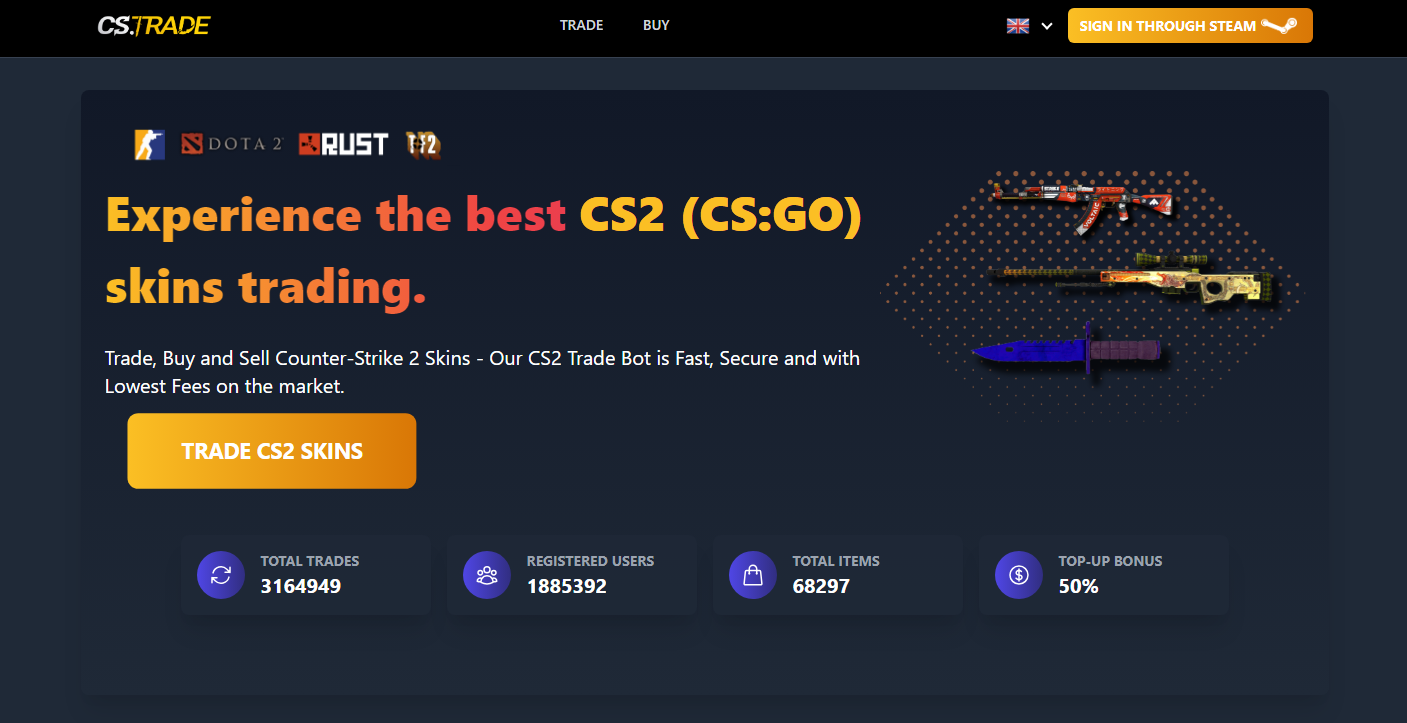

Bots That Bargain: How CS2 Trade Bots Are Changing the Game

Discover how CS2 trade bots are revolutionizing gaming strategies and maximizing profits in the virtual marketplace! Dive in now!

Understanding the Mechanics: How CS2 Trade Bots Operate

In the world of gaming, particularly with titles like Counter-Strike 2 (CS2), trade bots have become an integral part of the economy surrounding in-game items. CS2 trade bots function through automated scripts that facilitate the buying, selling, and trading of virtual items swiftly and efficiently. These bots operate based on algorithms that assess item values, monitor market trends, and execute trades in real-time. By leveraging APIs and data from various trading platforms, they can ensure that users receive the best possible deals without the need for manual input, thus streamlining the trading process for gamers who wish to enhance their experience.

Understanding the mechanics behind CS2 trade bots involves recognizing the various components that make them effective. First, they utilize complex algorithms that analyze historical data and current market dynamics to determine the optimal time for trades. Secondly, trade bots are programmed to respond to user commands, which can include specific trade requests and item evaluations. Finally, security measures are embedded within these bots to protect users from scams and ensure that trades are conducted within a safe environment. As technology evolves, so too does the sophistication of these bots, making them a valuable tool for any CS2 enthusiast looking to navigate the game's vibrant economy.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. Its competitive nature requires players to master various strategies and settings to improve their gameplay. For example, many players look for ideal configurations, such as zywoo settings, to enhance their performance in matches.

The Future of Trading: Are CS2 Trade Bots a Game Changer?

As the landscape of trading continually evolves, the introduction of CS2 trade bots presents a significant shift in how traders approach the market. These automated trading systems leverage complex algorithms to analyze market data and execute trades at lightning speed, allowing users to capitalize on opportunities that would be impossible to identify manually. With the ability to manage multiple trades simultaneously and operate 24/7, CS2 trade bots can minimize human error and emotional decision-making, leading to potentially higher returns on investment.

However, the rise of CS2 trade bots raises critical questions about the future of trading. Will these bots democratize trading by making sophisticated strategies accessible to the average investor, or will they create an uneven playing field where only those with advanced technology can compete? As we look to the future, it is clear that embracing this technology could be a game changer for the trading industry, provided that both traders and regulators adapt to the new paradigms of automation and algorithmic trading.

Top 5 Benefits of Using CS2 Trade Bots for Booming Bargains

In the fast-paced world of digital trading, CS2 trade bots have emerged as a game-changer, offering an array of benefits that can significantly enhance your trading experience. First and foremost, these bots operate 24/7, allowing traders to capitalize on market opportunities at any hour without the need for constant monitoring. This feature alone can lead to improved booming bargains, as the bots can execute trades instantly based on preset parameters, ensuring you don’t miss out on lucrative moments during off-peak hours.

Another remarkable advantage of using CS2 trade bots is their ability to analyze vast amounts of data at lightning speed. By leveraging advanced algorithms, these bots can assess market trends and indicators more effectively than a human trader ever could. As a result, they can identify potential booming bargains and execute trades that align with your investment strategy, all while minimizing the emotional toll that often accompanies trading decisions. With their capacity to maintain discipline and execute trades based on data rather than gut feelings, using trade bots can lead to a more structured and profitable trading approach.