Art Salmi: Discovering Creative Insights

Explore the world of art and creativity with insightful articles and inspiration.

Cryptocurrency Chameleons: The Ever-Evolving Trends in Virtual Currency

Discover the dynamic world of cryptocurrency with trends that shift like chameleons. Stay ahead in the game and unlock future profits!

What Are Cryptocurrency Chameleons and How Are They Changing the Market?

Cryptocurrency chameleons refer to digital currencies that adapt their characteristics and utilities over time, often shifting between different functions or use cases based on market demands and technological advancements. Unlike traditional cryptocurrencies that maintain a fixed purpose, chameleons can evolve, integrating features like smart contracts, privacy protocols, and staking mechanisms. This adaptability not only enhances their appeal but also positions them as versatile tools in the rapidly changing cryptocurrency market. For instance, a currency initially designed for transactional purposes may transition into a platform that supports decentralized applications (dApps), thus attracting a broader audience and user base.

The impact of cryptocurrency chameleons on the market is profound, as they introduce a level of dynamism that challenges conventional investing and trading strategies. Investors are now faced with the task of evaluating not just the current utility of a currency, but also its potential for future growth and transformation. As more projects adopt chameleon-like traits, we may see a shift towards long-term investments in adaptable assets rather than traditional, static cryptocurrencies. This evolution promotes innovation, fosters competition, and ultimately drives the overall expansion of the industry, making it crucial for market participants to stay informed about emerging trends in this vibrant ecosystem.

Counter-Strike is a highly popular first-person shooter game that emphasizes teamwork and strategy. Players join either the Terrorist or Counter-Terrorist team to complete objectives and eliminate opponents. For those interested in enhancing their gaming experience, a great way to do so is by using a csgoroll promo code which can offer various bonuses and rewards.

The Top 5 Evolving Trends in Virtual Currency You Need to Know About

As the world of finance continues to evolve, virtual currency has emerged as a predominant force reshaping how we perceive monetary transactions. The first trend to watch is the rise of decentralized finance (DeFi), which allows users to engage in financial activities — from trading to lending — without the need for traditional intermediaries. This shift not only increases accessibility but also enhances transparency in financial operations. Next, consider the growing popularity of non-fungible tokens (NFTs). These unique digital assets have revolutionized the concept of ownership in the digital realm, leading to new opportunities in art, gaming, and even real estate.

Another critical trend in the virtual currency space is the impending regulation of cryptocurrencies by governments around the globe. As regulatory frameworks begin to take shape, we can expect greater stability and legitimacy within the market, which could potentially draw more institutional investors. Furthermore, the emergence of central bank digital currencies (CBDCs) is on the horizon, with several countries exploring their issuance. This development could bridge the gap between traditional finance and the evolving digital landscape. Finally, the increasing focus on sustainability and energy-efficient solutions in cryptocurrency mining is becoming a hot topic, as environmental concerns lead to innovations aimed at reducing the carbon footprint of mining operations.

How to Identify Emerging Trends in the Ever-Changing World of Cryptocurrency

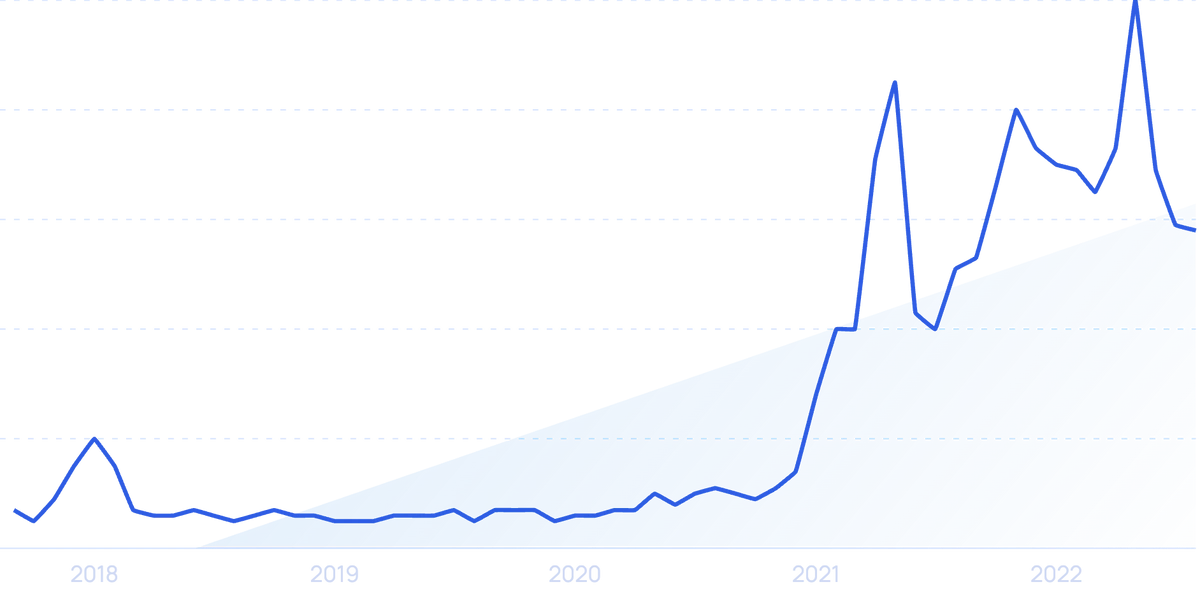

In the rapidly evolving world of cryptocurrency, identifying emerging trends can be a complex task. One effective strategy is to stay informed through a variety of reliable sources. Following leading cryptocurrency news websites, forums, and social media channels can provide insights into market sentiments and innovative developments. Participate in online communities and attend industry conferences to network with other enthusiasts and professionals. Additionally, utilizing tools such as Google Trends and Twitter analysis can help in tracking the popularity of specific coins and technologies over time.

Another method to pinpoint emerging trends is to analyze data from cryptocurrency market research platforms. Regularly reviewing metrics such as trading volumes, market capitalization, and transaction activity can reveal which cryptocurrencies are gaining traction among investors. Furthermore, keeping an eye on regulatory news and technological advancements can offer an early indication of potential shifts in the market landscape. By combining these approaches, you can develop a well-rounded perspective on where the cryptocurrency market is heading.